Hi there!

You are familiar with pillar 3a, but unsure which one to choose?

Well, I can well understand – after all, there are dozens of options. That’s why I’d like to introduce you to a pillar 3a that I use myself: frankly.

Hopefully I can help you to decide whether this pillar 3a is also suitable for you!

3-2-1 here we go!

When is frankly the right choice?

frankly is the right pillar 3a for you if you:

- are looking for a secure pillar 3a, as the Zürcher Kantonalbank is supporting frankly

- want to open your pension digitally without visiting a bank and manage it digitally via app or web

- want to invest in stocks and choose the strategy according to your individual risk profile

- are risk-averse and prefer to keep your pension money in an account solution with a fixed interest rate – frankly offers this as well

- want to save costs. With the all-in fee, frankly is 59% cheaper than comparable offers. And with the account solution, you pay no fees

- want to have full transparency over your 3rd pillar, because you have 24/7 access to your account and can track the performance

- want to save taxes

How to open an account with frankly

Opening an account with frankly is super easy and quick.

You can do this on their website or through the frankly app.

Simply download the app (Apple Store / Play Store) or click on this link to start the opening process.The app will guide you through the opening process with various questions.

For this, you also need a valid ID (Swiss ID / passport, foreigner’s ID B or C).

During onboarding, enter my code MONEYMADAM when asked for a voucher code; this will provide you with a fee credit of CHF 35.

Make then your first bank transfer of min CHF 1.-

Based on your answers to the questions, frankly will then recommend an investment strategy that best suits you and your needs. You can then set that one, or “override” the recommendation and choose another one with a different risk profile.

Good to know: With frankly, you invest in active and passive Swisscanto pension funds.

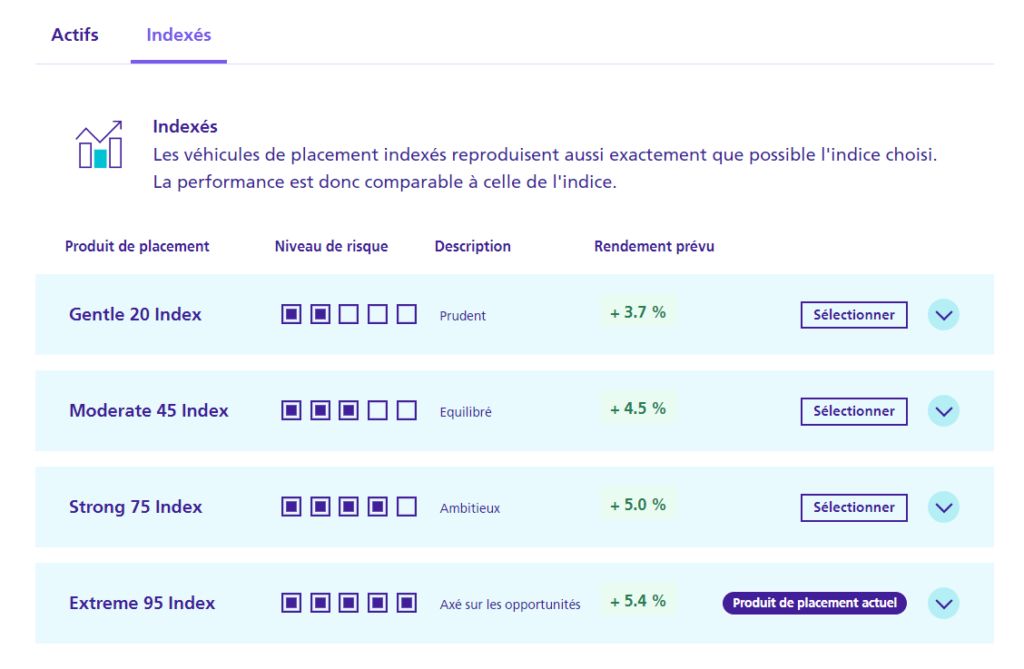

You can choose between five strategies and nine investment products.

I personally prefer the passive variant, but of course you can also choose the active variant.

At frankly you will find the passive option under the name “indexed”. Here you have the choice between four risk levels (from low equity share to high equity share – so low risk to very risky): Gentle 20 Index, Moderate 45 Index, Strong 75 Index and Extreme 95 Index.

Don’t worry, you can adjust your risk profile and strategy choice as many times as you want after onboarding (low/high risk, active or passive strategy, investment duration…).

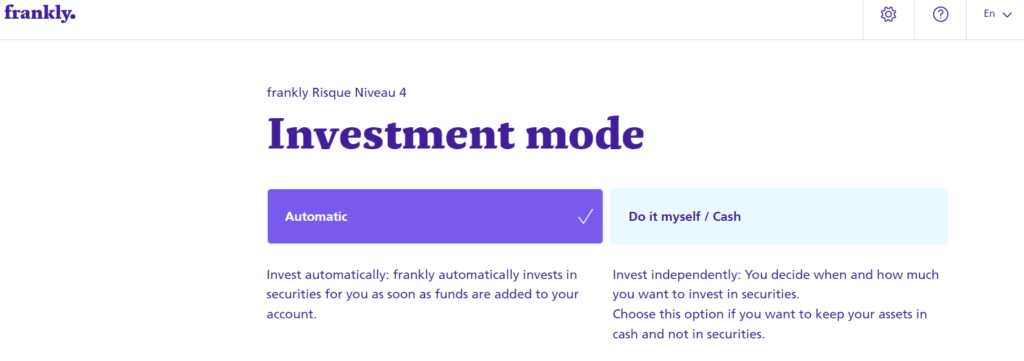

Furthermore, you can choose whether frankly should invest for you automatically (as soon as your account balance exceeds CHF 5 – my choice) or whether you prefer to invest manually and thus decide yourself when to invest or sell.

Today, only a few digital pillars 3a offer this. So if it interests you, try it out!

Whether smartphone, tablet or computer: With frankly, you know at any time how your assets are developing thanks to a well-structured chart, you can make deposits and have access to your investment strategy – wherever you are.

The best thing about frankly from my point of view: The great design, the easy handling, the solid financial institution (ZKB) in the background and the possibility to decide yourself when you want to invest.

Please note: Every time you close the frankly app, you log out. So remember your pasword well!

Getting the most out of your Pillar 3a

Here are some tips on how to get the most out of your Pillar 3a.

- Make sure you pay the tax-deductible maximum into your Pillar 3a by December 20 each year, so you can be sure the amount has arrived in your account(s) in time to be valid for deduction on your tax return. The maximum deductible amount in 2023 (the tax declaration you will fill out in 2024) is CHF 7’056.

- If you invest in securities with frankly, it is better if you automatically transfer a fixed amount to frankly every month, thus keeping your investment price low. Do you remember the famous DCA rule? The same applies here.

If you invest even a small amount every month, you will profit more.

Can I have multiple pillars 3a?

The answer is YES!!!!!!!!!!!!!

It is perfectly possible to have several pillars 3a. And it is even advisable to have several by the time you retire!

This way, you not only have the opportunity to test different providers, but you can also spread the risk. And remember, you’re free to pay as much as you like into your 3a pillar(s) each year – up to the maximum amount of CHF 7’056 in 2024.

Unlike pillar 3a insurance products, with pillar 3a bank products (i.e. also with frankly) you are not obliged to pay in an amount every month. That’s why I prefer pillar 3a bank products – apart from that they are also more profitable.

Why is it advisable to have several pillars 3a?

In general, it is worthwhile to open a new Pillar 3a from an amount of CHF 50,000; on the one hand for security reasons, and on the other hand to save taxes on the payout. Because when you retire, you can close your accounts one after the other over several years and thus optimize your taxes.

Here is some more information that might interest you

Who owns frankly?

frankly is developed by the Zürcher Kantonalbank (ZKB) and is a product of the pension foundation Sparen 3 of the Zürcher Kantonalbank.

How much does frankly cost?

frankly works with an all-in fee of 0.44%. It is possible that small fees may be added to some products. The fees are debited quarterly from your 3a assets.

FAQ

For more information on frankly, check out their website: Link

That’s it for this article. Feel free to write me your feedback and if you already use frankly in the comments.

To your investments!