Hello hello,

Do you also find that you pay way too much for your health insurance? Then that makes 2 of us!

And, bad news for us, with inflation and everything else that’s happened in the economy this year, insurance companies have found nothing better than to increase their premiums… Yeah, I know. A scandal.

Which makes it all the more important to choose the best health insurance for 2024!

And to do that, you’ll need to cancel your current health insurance BEFORE NOVEMBER 30 !!!

AND ESPECIALLY… pay your open invoices before DECEMBER 31 for the cancellation to be taken into account.

But before cancelling, because it costs money to send a registered letter, it’s important to compare the new health insurance premiums to see whether or not you’ll be changing this year, with the ultimate aim of OPTIMIZING your expenses.

Compare health insurance premiums

To compare premiums, it’s essential to use the official Confederation website Priminfo, as it’s the best health insurance comparator in Switzerland.

If you’ve been using Comparis up until now, switch to the Confederation site now, so you don’t get caught out by sponsored elements at the beginning or in the middle of the search results.

Now that the basics are out of the way, I’ll show you how to find the best insurance company by using my profile as an example.

First of all, which franchise to choose?

A quick reminder about deductibles. This is the amount you pay on top of your monthly premiums, before your health insurance covers 90% of your bills, leaving only 10% for you.

I’ve been with Assura for several years now. As I have frequent doctor’s appointments, I have taken out the minimum deductible of CHF 300.

To find out what deductible you need, we recommend calculating your medical expenses over the last 3 years. If you’ve paid more than CHF 1,850 per year, the CHF 300 deductible is a good option.

If you make very few visits to the doctor and have paid less than CHF 1,850 per year over the past 3 years, then the CHF 2,500 deductible is the best choice.

Here’s a small example of my insurance policy to help you understand why.

Deductible of CHF 300 (406.90/month): annual costs of CHF 4,882.8 + CHF 300 for you + CHF 155 (10% of CHF 1,550) = CHF 5,337.80.

Deductible of CHF 2,500 (CHF 292/month): annual costs CHF 3,504 + CHF 1,850 for you (you pay the full amount up to CHF 2,500) = CHF 5,354.

As for me, I know I’ll soon be paying CHF 2,000 a year, so I chose the CHF 300 deductible and pay CHF 406.90 with Assura Pharmed.

But I can only encourage you to take the CHF 2,500 deductible if you don’t have many medical expenses: you’ll save even more!

Find your health insurance

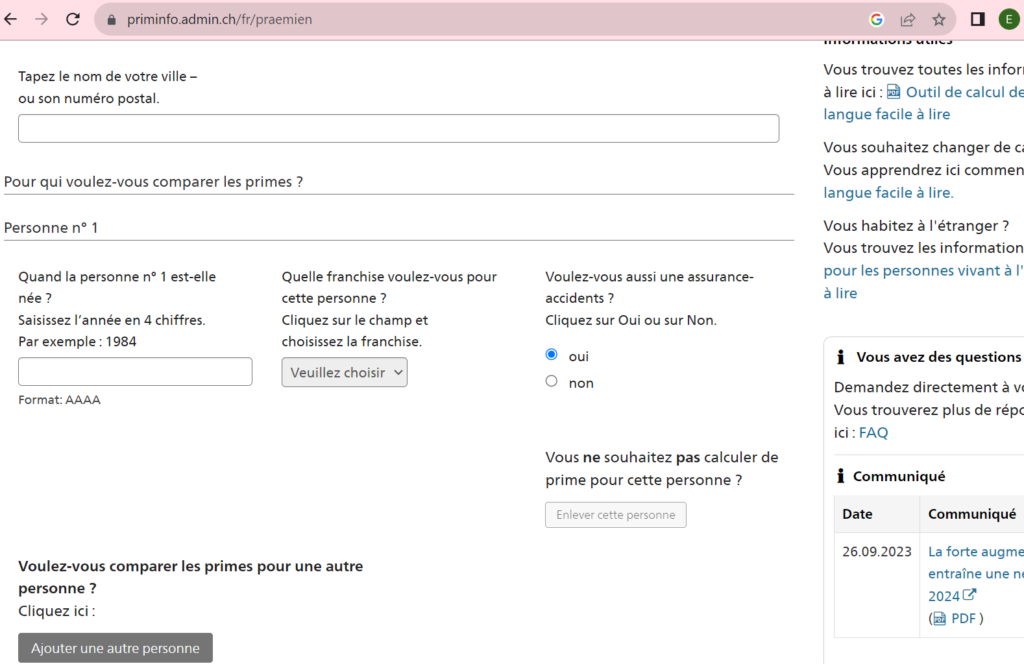

Now that you know which deductible you need, go to Priminfo.

Enter your postal code and address, your year of birth and your current deductible (put in the one you want for 2024).

If you’re an employee, tick No for accident cover, as you’re covered by your employer (wouldn’t it be silly to pay twice?).

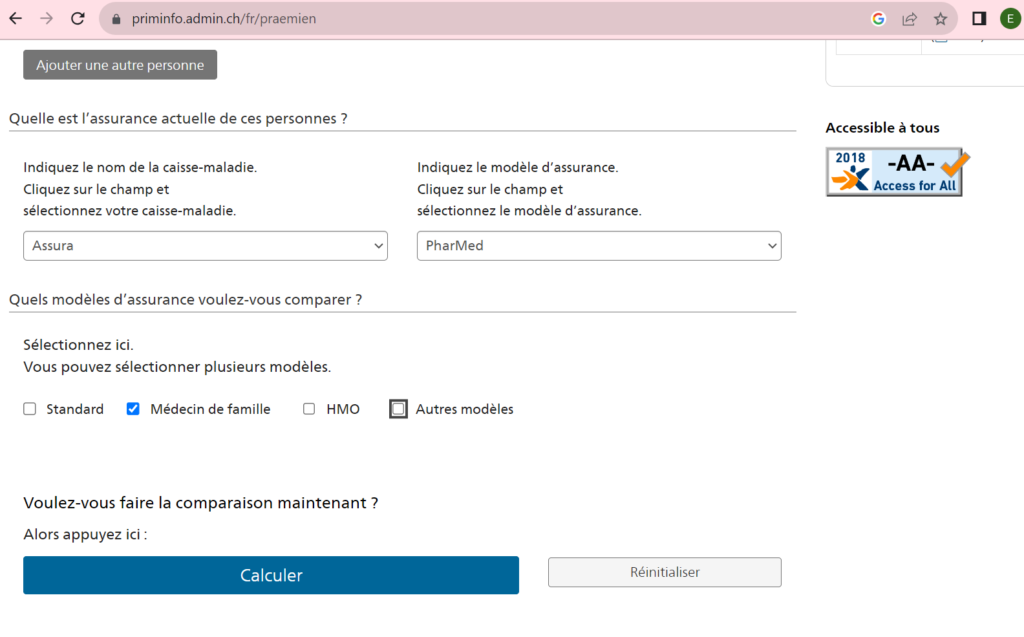

Choose your current health insurer and insurance model.

If you have a spouse and/or children, you can add more people and enter their details.

You can choose the insurance models to be displayed, such as standard, family doctor, HMO (in the event of problems, you must first contact a group practice or doctor’s network) or other models.

Then press Calculate.

For my part, I’ve selected the family doctor option as I’d like to choose my doctor.

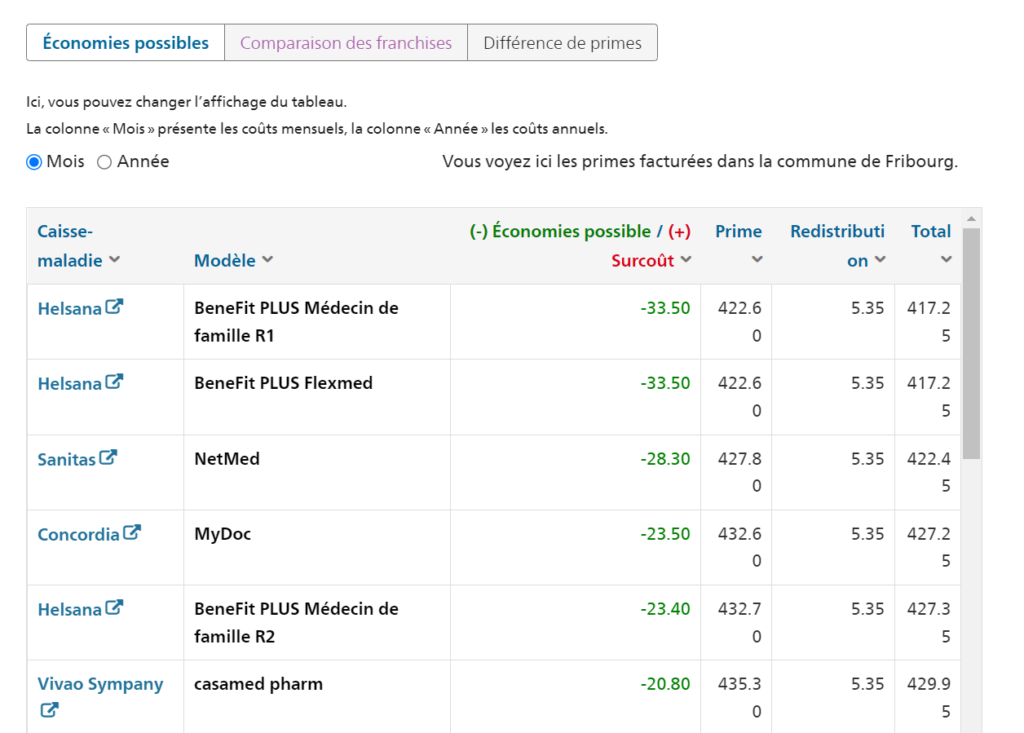

Results are displayed by potential savings. You can also display the results to compare deductibles. Finally, you can see premium variations, but this isn’t very interesting.

In my case, the best health insurance is Helsana with the BeneFit PLUS Médecin de famille R1 model. It would save me CHF 33.50 per month, or CHF 406 per year!

Invested in the stock market every month on Yuh, Swissquote or Interactive Brokers, this CHF 33.50 will become CHF 6,075.75 after 10 years, thanks to the power of compound interest.

Cancelling your health insurance

If you’ve found health insurance that’s cheaper than the one you’re currently paying, then send your cancellation by A Mail so that your current insurer receives it BEFORE NOVEMBER 30!

Here’s a sample letter you can download to cancel your KVG insurance.

As a reminder, all your outstanding bills must be paid by December 31 of the termination year for your termination to be accepted.

Then register on the portal of your future health insurance company before the end of the year.

So much for today’s article. I very much hope it will help you save money next year! Don’t hesitate to let me know if you’re changing health insurance in 2024 and your feedback in the comments. I’d love to hear from you.

See you soon!